We use predominantly ETFs in our portfolio construction. The main reason for that is the versatile possibilities of creating well-diversified portfolios with ETFs as well as good liquidity and attractive pricing of the instruments. Based on Bank of America’s calculation, there are approximately 7000 different ETFs trading in the markets and the total AUM is estimated at around USD 5300.

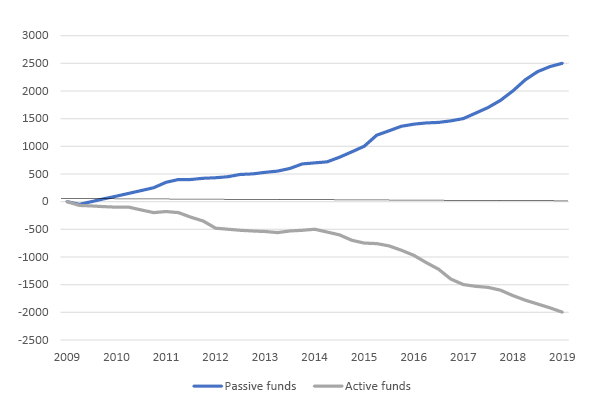

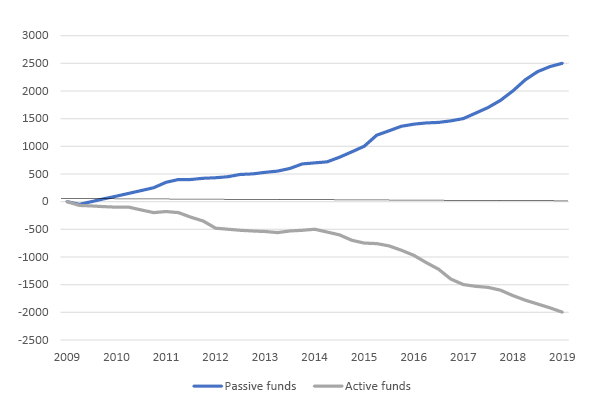

Currently, ETFs provide almost limitless possibilities for portfolio construction. In equities they enable efficient and flexible diversification of assets to practically all geographical areas and industry sectors. In fixed income, ETF products cover various fixed income segments and geographically all relevant markets. The rapid increase in popularity and fast expansion of the ETF market are explained by high liquidity of the products as well as flexibility that ETFs offer in building diversified portfolios. Over the last years there have been two notable trends; ETFs and other passive investment instruments have attracted sizable amounts of new assets while traditional actively managed funds have seen a strong outflow of money.

Cumulative capital flows to passive equity funds vs. active equity funds, USD billion

Source: BofA Merill Lynch

In discretionary asset management Front Capital is responsible for constructing and managing investment portfolios based on risk budget and return target that has been set together with each client. Our portfolio management is open and transparent. We do not do any unnecessary trading – instead, we carry out trades only when necessitated by the market situation.

High ethics and responsible investing are strongly present in our everyday work. Our aim is to bring easiness and create sophisticated but smooth investment solutions for our clients. In addition to one’s own Asset Manager, we offer comprehensive on-line reporting and electronic transaction services.

The total cost (TER, total expense ratio) of our discretionary asset management is comprised by four separate pricing elements:

- Annual asset management fee charged by Front Capital (subject to VAT 24 %)

- Custodian fee (subject to VAT 24 %)

- Trading fees, for ex. when buying and selling ETFs (subject to VAT 24 %)

- Product fees charged by ETF providers. These fees are included in the market price of the products and the cost is deducted on the daily basis from the value of the investment instrument